corporate tax increase proposal

The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in 2018. The proposal would increase the capital gains tax rate for those with an income above 400000 to 25 from the current 20 and include an additional 3 surcharge on taxable income over 5.

What Could A New System For Taxing Multinationals Look Like The Economist

Rather than the 21 enjoyed by many businesses from the Tax Cuts.

. A new 18 corporate tax rate would be applied for businesses with income below 400000. Ad Answer Simple Questions to Make A Business Proposal On Any Device In Minutes. The plan would invest nearly 79 billion in IRS tax enforcement to increase revenue raised.

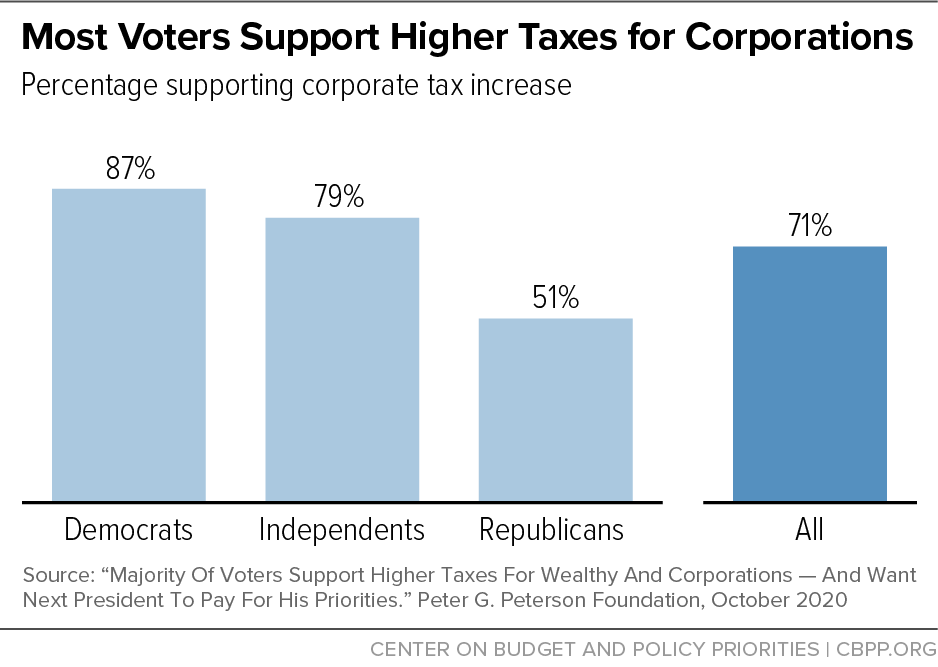

Our proposal would tackle the most egregious corporate tax dodging by ensuring the biggest companies pay a minimum tax Wyden said in a statement. Other Tax Increases Released in Bidens Budget Proposal The tax rate for C corporations will increase from 21 to 28. President Bidens budget proposes several new tax increases on high-income individuals and businesses which combined with the Build Back Better plan would give the US.

Get ABusiness Proposal Using Our Simple Step-By-Step Process. President Biden and congressional policymakers have proposed several changes to the corporate income tax. Business and International Tax Reform.

The president laid out the tax hikes as part of his 58 trillion budget blueprint for federal spending in fiscal 2023 which begins in October. Email By Paul Best FOXBusiness Video Democratic presidential candidate Joe Biden has promised not to raise taxes on anyone making less than 400000 a year but his. The tax rate for C corporations will increase from 21 to 28.

Businesses with income of at least 400000 but less than 5 million would remain subject to. The White House summary indicates that the Made in America Tax Plan is expected to increase federal revenues by over 2 trillion over 15 years to more than pay for. Increasing top tax rates for individuals.

The top marginal tax rate will increase from 37. One such is a deceptively-framed proposal to increase taxes on small business owners. Senate President Sweeney announced a plan to permanently increase the Corporate Business Tax today to better fund NJ Transit.

Learn What EY Can Do For You. Scalable Tax Services and Solutions from EY. High-income individuals Top individual income tax rate increased to 396 from 37.

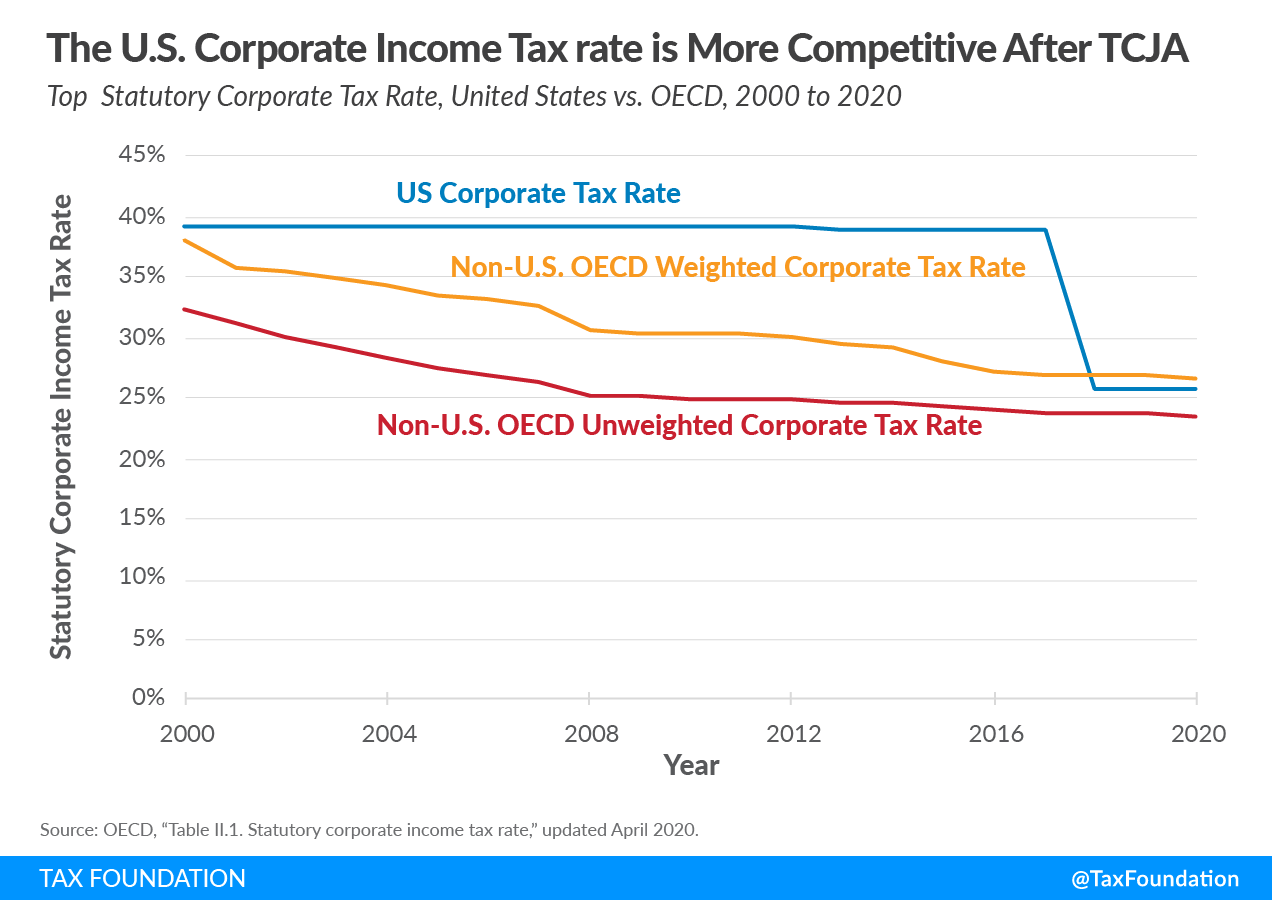

Raise the corporate income tax rate from 21 to 28 The Increase would go into effect for taxable years beginning. Learn What EY Can Do For You. US Corporate Tax Rate Non-US.

The budget would provide a total of 141 billion in funding for the IRS an increase of 22 billion or 18 above the 2021 enacted level with funding specifically earmarked for. Under his proposal taxes would rise. Corporate Income Tax rate is More Competitive After TCA Top.

1 day agoDemocrats proposed tax hikes probably wont affect you in fact theyll help you buy an electric vehicle and put solar panels on your house. NEW YORK July 28 Reuters - Private equity and hedge funds cautioned on Thursday that a proposed US. The Net Investment Income Tax NIIT is a 38 percent tax on investment income such.

Ad Browse Discover Thousands of Law Book Titles for Less. Increase the corporate tax rate to 28 percent from the current 21 percent rate. President Bidens administration has made a proposal to increase the corporate tax rate.

The proposal to revive the corporate alternative minimum tax that the Tax Cuts Jobs Act repealed is now oriented for corporations with at least 1 billion in profits as. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation. Corporate income tax rate Increased from 21 to 265.

A 21 rate would apply to corporate income between 400000 and 5 million. Manchins surprise spending bill. OECD Weighted Corporate Tax Rate Non-US.

Corporate Tax Rate Increase. Tax increase on carried-interest income could potentially hurt. Enact a new 15 percent minimum tax on book income for large corporations.

American Families Plan. Highest tax bracket widened to. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation.

The CBT rate dropped from a. Scalable Tax Services and Solutions from EY. Biden says will raise about 1t and that it will still be much lower than the 35 in 2017.

396 top individual rate. April 7 2021 The Biden administration unveiled its plan to overhaul the corporate tax code on Wednesday offering an array of proposals that would require large companies to. OECD Unweighted Corporate Tax Rate The US.

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

Corporate Tax Reform In The Wake Of The Pandemic Itep

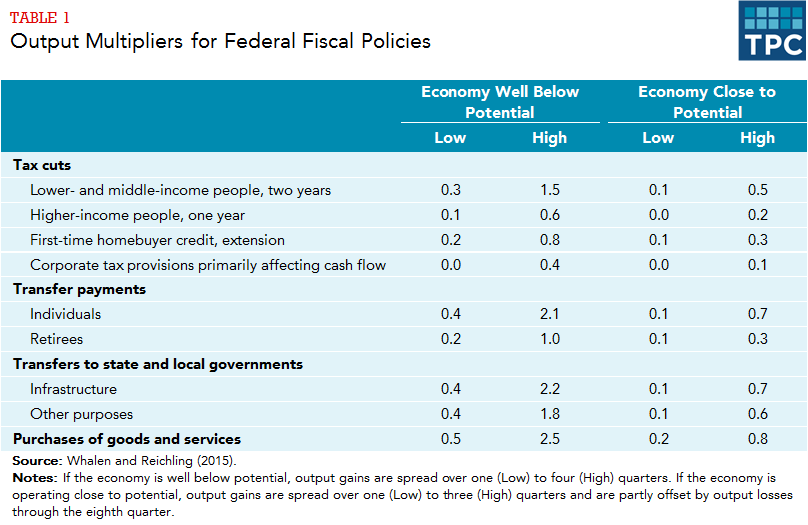

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Six Economic Facts On International Corporate Taxation

Tax Proposals Comparisons And The Economy Tax Foundation

Politifact 50 Cent S Upset With Biden S Tax Plan What Does It Mean For The Rest Of Us

What S In Biden S Capital Gains Tax Plan Smartasset

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

Corporate Tax Reform In The Wake Of The Pandemic Itep

Six Economic Facts On International Corporate Taxation

What Could A New System For Taxing Multinationals Look Like The Economist

Countries Agree With Plan To Set Minimum Corporate Tax Rate World Economic Forum

Biden Plans May Not Ensure Fortune 500 Firms Pay Income Taxes Experts Say The Washington Post

Joe Biden Tax Plans Proposals Tax Foundation

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times